New Social Security Bill Would Raise Monthly Benefits and Strengthen the Program Long Term

5 min read

Social Security benefits are once again at the center of the national conversation, as new legislation aims to increase monthly payments, modernize cost-of-living adjustments, and shore up the program’s long-term finances.

On Dec. 16, 2025, Hawaii Sen. Brian Schatz introduced the Safeguarding American Families and Expanding Social Security (SAFE Social Security) Act, a proposal designed to expand benefits for seniors and families across the country.

If passed, the bill would increase average Social Security benefits by more than $150 per month, adjust how annual increases are calculated to better reflect retirees’ real-world expenses, and extend the life of the Social Security trust fund by changing how payroll taxes are applied. For millions of Americans who rely on Social Security as a primary source of income in retirement, these changes could be significant.

As debates continue in Washington about the future of Social Security, the SAFE Social Security Act represents a clear push to expand, rather than cut, benefits — while also addressing long-standing concerns about fairness and solvency.

To keep track of all the legislation affecting your benefits, stick with BenefitKarma.com.

Why this bill matters right now

Social Security is the largest and most successful retirement and disability program in U.S. history. Yet many beneficiaries say their monthly checks haven’t kept pace with rising costs for housing, food, health care, and utilities. At the same time, policymakers continue to warn that the Social Security trust fund faces long-term funding challenges if no changes are made.

According to Sen. Schatz, the SAFE Social Security Act is meant to tackle both problems at once: boosting benefits for today’s seniors while strengthening the system for future retirees. That dual focus is a major reason the bill is drawing attention from advocacy groups, labor organizations, and older Americans.

The issue is especially pressing in the senator’s home state of Hawai‘i, where more than 280,000 residents (over one in six people) receive Social Security benefits. By 2040, seniors are expected to make up more than 20 percent of the state’s population, increasing reliance on the program even further.

What the SAFE Social Security Act would do

The bill includes several key provisions aimed at both benefit adequacy and long-term funding. In plain terms, here’s what it proposes:

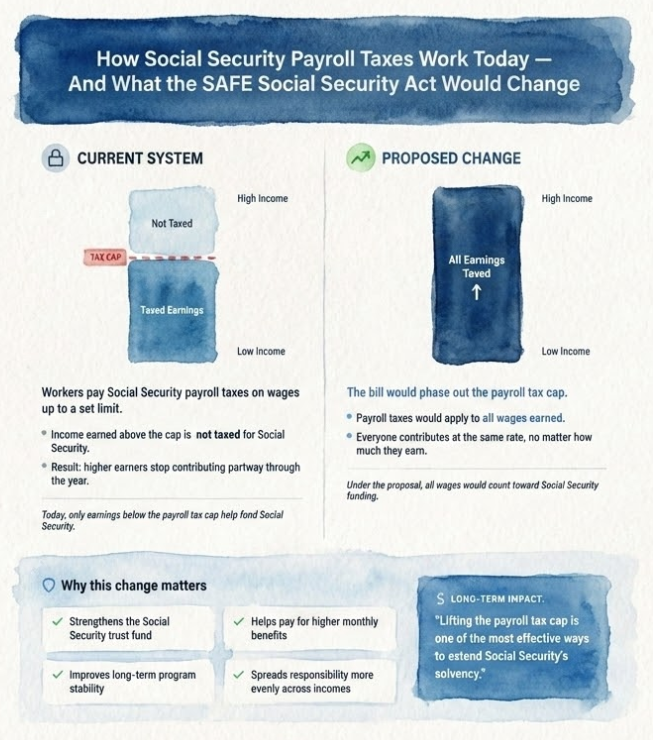

Phase out the payroll tax cap so that payroll taxes apply to all wages, not just income below a set limit

Increase average monthly benefits by more than $150 through updated benefit calculations

Improve annual cost-of-living adjustments (COLAs) by using the Consumer Price Index for the Elderly (CPI-E), which better reflects seniors’ spending patterns

Today, only wages up to a certain amount are subject to Social Security payroll taxes. Earnings above that cap are not taxed for Social Security purposes, meaning higher earners pay a smaller share of their income into the system. The SAFE Social Security Act would gradually eliminate that cap, requiring high earners to contribute on all wages.

Supporters argue that this change alone would significantly extend the life of the trust fund while making the system more equitable.

Bigger checks and more accurate COLAs

One of the most immediate impacts for beneficiaries would be larger monthly payments. By adjusting how benefits are calculated, the bill would raise average Social Security checks by more than $150 per month.

For retirees living on fixed incomes, that increase could help cover essentials like groceries, prescriptions, or utility bills. (Or just mitigate increasing inflation.)

The bill also proposes switching to the Consumer Price Index for the Elderly when calculating annual COLAs. The current formula is based on spending patterns of younger, working households, which tend to allocate less money to health care. CPI-E places greater weight on medical costs and housing, expenses that often rise faster for older Americans.

Who supports the legislation

The SAFE Social Security Act has drawn support from several major labor and advocacy organizations, including the AFL-CIO, the Alliance for Retired Americans, the American Federation of Teachers, Social Security Works, and the National Committee to Preserve Social Security and Medicare.

Jody Calemine, Director of Government Affairs for the AFL-CIO, called lifting the payroll tax cap “the fairest and most equitable way” to improve benefits while extending the program’s solvency. Advocates also point out that the bill protects workers who leave the workforce temporarily to care for loved ones, ensuring they are not penalized when they retire.

What happens next

Introducing a bill is only the first step. The SAFE Social Security Act will need to move through congressional committees and gain broader support before it can become law. While the proposal faces political hurdles, it signals a growing push among some lawmakers to expand Social Security benefits instead of reducing them.

For seniors, near-retirees, and families planning for the future, the bill highlights what’s at stake, and what changes could be possible.

If you rely on Social Security now or expect to in the future, staying informed about proposals like this one can help you understand how benefits may change and what to watch for as Congress debates the program’s future.