Social Security Doesn’t Accept Power of Attorney: Why that Matters for Your Benefits

5 min read

When planning for your future, most people assume that a power of attorney (POA) is enough to protect their finances if they ever need help. After all, a POA is widely accepted by banks, insurance companies, and investment firms. It’s often viewed as a catch-all solution for managing money and making decisions if illness, disability, or age gets in the way.

But when it comes to Social Security, that assumption can lead to serious problems.

The Social Security Administration (SSA) does not recognize traditional powers of attorney. Even if you’ve legally named someone to manage your finances, that person may have no authority to access or manage your Social Security benefits. For millions of Americans who rely on these payments each month, this overlooked rule can create confusion, delays, and financial stress at exactly the wrong time.

Understanding how Social Security handles benefit management is an important, but often missed, estate planning step, especially for people who are applying for benefits, already receiving them, or expecting help from a family member in the future. Staying informed about rules like this can help you avoid surprises later.

Sign up for BenefitKarma.com to keep up with important updates and practical guidance on government benefits.

Why Social Security doesn’t accept power of attorney

A power of attorney is a legal document created under state law. It allows one person to act on behalf of another for financial or legal matters. In most areas of life, that authority is enough.

Social Security is different because it operates under federal law and follows its own rules to protect beneficiaries. The SSA is required to work directly with the person receiving benefits unless it has formally approved someone else to act on their behalf. As a result, Social Security will not honor a POA, even one that is legally valid, notarized, and accepted everywhere else.

This means that someone with power of attorney typically cannot:

Speak to Social Security on your behalf

Change direct deposit information

Resolve payment problems

Manage benefit applications or appeals

Families often don’t discover this limitation until a crisis happens. A loved one may become seriously ill, develop cognitive issues, or be unable to communicate. Even with the best intentions and legal paperwork in place, Social Security may refuse to share information or allow any action.

Who this rule affects most

This issue is especially important for people who:

Receive Social Security retirement benefits

Receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI)

Are in the process of applying for benefits

Rely on a spouse, adult child, or caregiver to manage finances

Expect to need help managing benefits later in life

Social Security benefits often make up a large portion of monthly income. If no one is authorized to help manage them, payments can be delayed, interrupted, or left unresolved during periods when financial stability is critical.

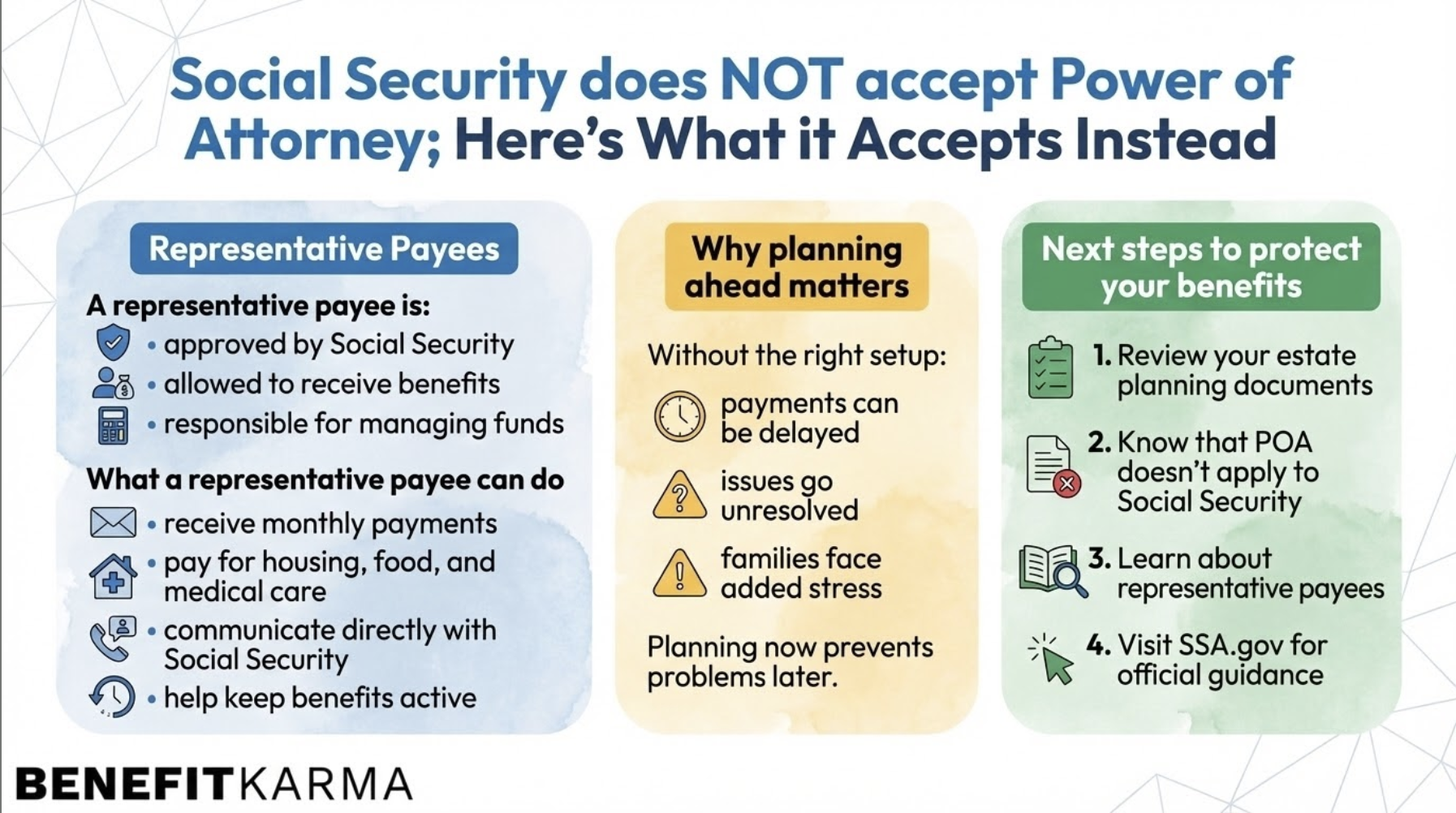

'Representative payees' are Social Security’s alternative

Instead of accepting power of attorney, the SSA uses a system called representative payees. A representative payee is a person or organization that Social Security officially approves to receive and manage benefits for someone who needs assistance.

A representative payee can:

Receive monthly benefit payments

Pay for essential needs like housing, food, utilities, and medical care

Communicate directly with the SSA

Report changes and handle benefit-related paperwork

Representative payees are commonly used for people with disabilities, cognitive impairments, or serious medical conditions. However, they can also be used when someone simply needs help managing their benefits, even temporarily.

Why this planning step is often overlooked

Many people assume that estate planning documents automatically cover everything. Because power of attorney works almost everywhere else, Social Security’s exception catches families off guard.

This can lead to frustrating situations where benefits are technically approved but practically inaccessible. Loved ones may be unable to fix errors, respond to notices, or stop overpayments. In some cases, missed deadlines can even result in suspended benefits.

Planning ahead allows you to avoid scrambling later, especially during stressful or emotional situations.

How to plan ahead to protect your benefits

The best time to address this issue is before a problem arises. Start by reviewing your current estate planning documents and asking one key question: Who would manage my Social Security benefits if I couldn’t?

If you already have a power of attorney, understand that it does not give access to Social Security. You may want to talk with your family about who could serve as a representative payee if needed.

Some people also choose to consult an elder law or estate planning attorney. A professional familiar with Social Security rules can help you understand how representative payees fit into a broader financial plan without duplicating or conflicting with other documents.

How the representative payee process works

To become a representative payee, a person or organization must apply directly through the SSA. Social Security reviews applications carefully and chooses the option it believes is in the beneficiary’s best interest.

The process generally involves:

Submitting an application

Providing identification and background information

Explaining the relationship to the beneficiary

Demonstrating the ability to manage funds responsibly

Once approved, the representative payee has ongoing responsibilities, including keeping records and using benefits only for approved needs. Social Security provides guidance and oversight to help ensure funds are used properly.

The SSA’s official website offers detailed instructions, forms, and explanations about representative payees, making it a useful starting point for anyone considering this option.

Why understanding this now can save stress later

This isn’t about expecting the worst; it’s about being prepared. Many benefit disruptions happen not because of fraud or mistakes, but because families don’t know the rules until it’s too late.

By understanding how Social Security actually handles benefit management, you can protect your income, reduce confusion for loved ones, and make sure support is available when it’s needed most.

BenefitKarma helps break down complex benefit rules into clear, practical information so you can plan with confidence and stay informed as policies change.